Resolv Community Update — July Edition

wstUSR on Binance Wallet, USR on CEX, RESOLV on Bithumb, yield update & new integrations

No fluff — just another month of building.

Binance. Bithumb. New vaults. stRESOLV boost. And real yield that keeps climbing.

Let’s recap where things stand — and where we’re headed. 👇

Product performance

Yields continue to perform — with Resolv’s native strategies delivering across both tranches.

→ TVL: ~$504M (+50% growth over 14 days)

→ Collateral pool 7D APR: ~17%

→ stUSR 7D APR: ~12%

→ RLP 7D APR: ~23%

This is before factoring in points or strategies with integrations — and all fully onchain.

As protocol integrations deepen, liquidity expands, and incentives grow, Resolv is positioning itself as one of the most reliable onchain yield engines — fully transparent, modular, and built to last.

Season 1 claims closed — Season 2 allocation expanded

The Season 1 points program ended with 10% of total $RESOLV supply allocated to early users. Claims officially closed on June 27, with:

~92% of tokens successfully claimed

7.75M $RESOLV unclaimed — now rolled into Season 2

This brings the total Season 2 allocation to 5.75% of total supply, with 4% reserved for the ongoing points program.

Season 2 runs until September 9, with more integrations, partner campaigns, and vaults being rolled out.

Resolv x Binance Wallet — $600K campaign live

Resolv yield is now natively integrated into Binance Wallet via the Yield+.

Users can stake stablecoins (USDC or USDT) directly in-app and receive wstUSR, earning:

Base yield (~14% 7-day APR at time of writing)

Daily share of $RESOLV rewards

5 points per wstUSR in Season 2

A major milestone for Resolv — bringing yield into everyday wallet flows. No bridging, no custom UIs — just native access to real yield in one of the most widely used wallets.

The campaign runs July 9 – Sept 21, with a $600k rewards pool and a minimum deposit of just 25 USDT/USDC.

Resolv x P2P.org — scaling sustainable yield distribution

Resolv has partnered with P2P.org, one of the largest staking providers in crypto — unlocking a major distribution pathway for stable, crypto-native yield.

Through this collaboration, P2P.org’s clients will gain seamless access to Resolv products via a wide network of wallets, exchanges, custodians, and neobanks — reaching over 40,000 delegators across 80+ networks.

Both teams are aligned around a shared goal: long-term stablecoin solutions development and sustainable DeFi-native returns. Together, we’re expanding access to structured yield for the next wave of users — from individuals to institutional flows.

More on this to be announced soon.

First CEX listing for USR + 7% flexible staking

Resolv’s delta-neutral stablecoin USR is now listed on a centralized exchange for the first time — LBank.

This is an important step in making USR accessible beyond DeFi-native platforms, bringing it to a wider audience.

In parallel, LBank has also launched 7% APY flexible staking for USR holders.

Vaults are live — smarter yield, fewer steps

Vaults are now live on Resolv — the first step toward automated, ecosystem-native yield strategies.

With Vaults, your USR is deployed across integrated protocols to earn real yield and stack ecosystem incentives — no spreadsheets, bridging, or guesswork required.

The first vault: HyperUSD by Mizu, a direct integration into the Hyperliquid ecosystem. Deposits are bridged to HyperEVM and deployed across protocols like HyperSwap, Hypurr, Harmonix, HyperLend, Timeswap, and Silhouette, earning up to 30x Resolv points and partner incentives for liquidity allocated.

This is just the beginning — more vaults are in the pipeline, with direct deposits via the Resolv app coming soon.

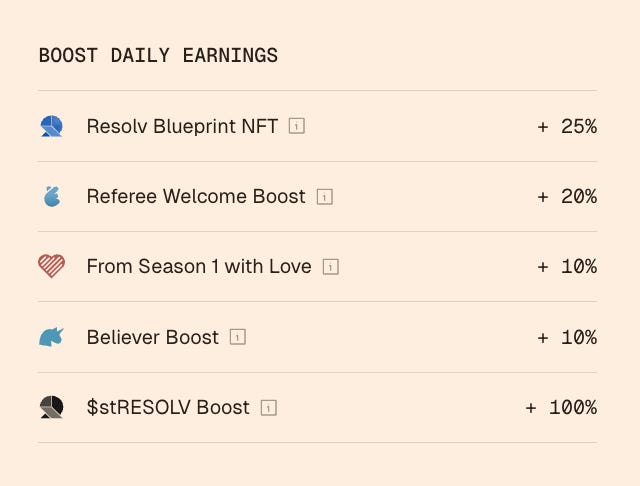

stRESOLV Boost is live - earn more points per $ provided

Points just got an upgrade. The stRESOLV Boost is now live — applying a protocol-wide multiplier to your Season 2 points.

It amplifies your point earnings across all the point activities based on how much $RESOLV you’ve staked relative to your liquidity in Resolv point integrations.

Boost % = Value of staked RESOLV / Value of all point-earning positions (capped at 100%)

Example:

• $5k in staked RESOLV

• $5k in USR, RLP, and Pendle/Morpho positions

→ You receive a 100% boost on all points earned.

Boost is calculated using a 30-day average price of $RESOLV and apply retroactively across Season 2 activities.

P.S. Your boost updates dynamically as your activity grows — so expect your dashboard to evolve as retroactive activities start going live.

One stake. Protocol-wide amplification.

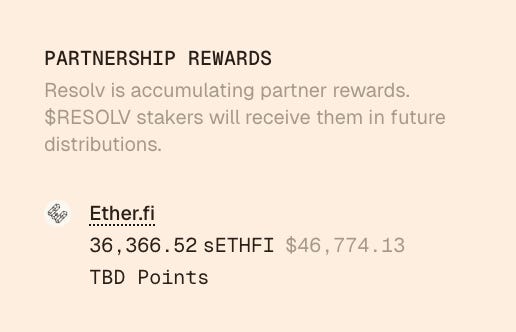

First partnership rewards now visible in-app

The first wave of partnership rewards is now visible directly in the app — marking the start of the dual rewards stream for $RESOLV stakers.

Resolv wallets have begun accruing rewards from integrated protocols like EtherFi, with 36,366 sETHFI already accumulated and earmarked for distribution to $RESOLV stakers.

This is just the beginning. This stream will expand over time as more integrations go live and additional partners contribute to Resolv’s long-term flywheel, with $RESOLV stakers receiving their share in upcoming distributions. More details will be shared as they become available.

$RESOLV updates

stRESOLV TVL: ~49M RESOLV staked

stRESOLV APR: ~50% base APR

$RESOLV is listed on Bithumb

Another step toward broader access: $RESOLV is now listed on Bithumb, one of the largest exchanges in South Korea.

With this listing, Resolv expands access to a new region and new audiences — part of our strategy to make Resolv known to global users across centralized and decentralized rails.

$RESOLV Foundation buybacks

Since launch, Resolv Foundation has executed multiple buybacks, including:

1.6M $RESOLV at ~$0.15

1.1M $RESOLV at ~$0.144

This strategy underscores long-term alignment with holders and confidence in Resolv’s performance. While we saw the questions on providing the address to track the buybacks, currently all of them are executed on CEXes and official protocol-driven buybacks from fee switch are not turned on yet. We will be sharing more updates in the future on the transparency framework.

What’s next for the token?

Looking ahead, Resolv is focused on building long-term value through adoption and protocol usage.

Key growth drivers:

Staking service provider integrations — starting with partners like P2P.org, one of the largest ETH/BTC distribution networks. These partnerships unlock new deposit flows into USR by routing underlying inventory into scalable, neutral stablecoin products.

The USR Ecosystem Vault — launching soon to pair stable yields with high point exposure across integrations. This vault will deepen liquidity and generate protocol revenue, which will be recycled into buybacks.

New value-add revenue streams — such as from our integration with EtherFi, where Resolv routes ~$130M into their liquid staking ecosystem. Partner tokens earned through these deployments is allocated to RESOLV stakers as a part of dual reward stream — without taxing the collateral pool.

These combined flows already have the potential to fully offset token emissions to stakers in 2025 (estimated at ~$4M/year), creating a sustainable foundation for long-term alignment and buyback support.

Full post: Tim’s update

New integrations

Contango enables capital-efficient leverage on Resolv assets via looping. New RLP loops help compound returns, deepen borrow demand, and create flywheel effects across yield products.

RLP, wstUSR & USR on Silo Finance

All tokens are now integrated into Silo’s isolated lending markets. This enables structured lending/borrowing strategies around Resolv assets and creates a new use case for RLP as productive collateral.

Fluid now supports wstUSR with three pools, bringing more visibility and composability to Resolv’s core stable-yield asset across chains and dApps and its pools serving as the underlying liquidity rails for the Binance Wallet campaign.

wstUSR–RLP pools are live on Balancer and Curve

New deep liquidity pools on Balancer and Curve, a productive pairing of two yield-bearing assets. These pools deepen liquidity between the Resolv’s core products and enable efficient rebalancing and swaps — while delivering strong native yield and 30x Resolv points to LPs.

Spectra RLP pool with new maturity date

New RLP pool is live on Spectra to access permissionless yield tranching strategies. Adds structured exposure options for users and brings deeper integration into yield strategy platforms - continuing in season 2 points program.

New USR strategy added to ListaDAO, giving BNB Chain users an accessible way to earn real yield. Strengthens USR’s presence in BNB-native ecosystems.

New Extrafi pool — exUSR–exUSDC on Balancer

Resolv expands into the Balancer-powered ExtraFi ecosystem with a new pool pairing exUSDC and exUSR. This opens up stable, modular exposure for ExtraFi users — with triple rewards: Balancer fees, EXTRA incentives, and 30x Resolv points.

This vault leverages GAIB’s algo-based allocation engine to create a low-maintenance yield path into Resolv — combining algorithmic vaulting with dual incentives: Resolv points + GAIB’s SPICE points. Helps distribute USR into structured vault products.

wstUSR is now available on Base

You can now bridge staked USR to Base via Stargate — or swap directly on-chain.

A new pool is live on Aerodrome, pairing USR with wstUSR — enabling efficient swaps and deeper liquidity for stakers on Base.

Community highlights

Another audit completed

Resolv successfully completed another audit, this time with MixBytes — reinforcing our ongoing commitment to transparency and safety.

Web3 security panel with Immunefi & more

Resolv joined leaders from Immunefi, ChainSecurity, Injective, and ChainPatrol for a panel on the future of Web3 security.

Smart discussion on audit standards, attack surfaces, and protocol defense.

AMA with GAIB

Catch our latest community AMA with GAIB, covering how Resolv fits into their AI x DeFi vision — and the composability of yield-bearing stablecoins.

Founder's interview with ecoFND

Ivan breaks down how structured products inspired Resolv’s stablecoin design — plus behind-the-scenes dynamics with co-founders Fedor and Tim, and what’s next post-raise.

Podcast with Wallfacer Labs

A deep dive into how Resolv works — and where we’re headed. Ivan covers tranching, risk profiles, distribution mechanics, and new yield frontiers.

Flash talk at Stable Summit

CTO Fedor Chmilev gave a flash talk at Stable Summit, breaking down how stablecoin architecture shapes scalability and future DeFi yield flows.

That’s all for now — and as always, thanks for being part of the journey.

More integrations, strategies, and partner announcements are already underway.

Let’s keep building.

— Resolv Team

11111

11111